Total capital allowance NGN 250000 112500 NGN 362500. This lecture will cover Misc issues of CA like 1 Disposal2 Small value Asset 3 Short Life AssetFeel free to read my Blog at lowchinannblogspot.

Chapter 7 Capital Allowances Students

In Malaysia any sale made from your investments is not subject to the capital gains tax.

. Annual allowance at the. How to Calculate Capital Allowances. Malaysia Taxation Of Cross Border M A Kpmg Global from assetskpmg A company may claim capital allowances for capital expenditure.

B calculation of balancing. 8 Oktober 2018 INLAND REVENUE BOARD OF MALAYSIA _____ Page 2 of 19 43 The conditions that must be fulfilled by a person to. Annual allowance AA NGN 1000000 250000 9 12 20 NGN 112500.

In this article seekers will share a review of 3 types of allowances with reference from the inland revenue board of malaysia lhdn tax ruling and how the allowances affect the. Regarded as part of the cost of machine. How To Calculate Capital Allowance Malaysia.

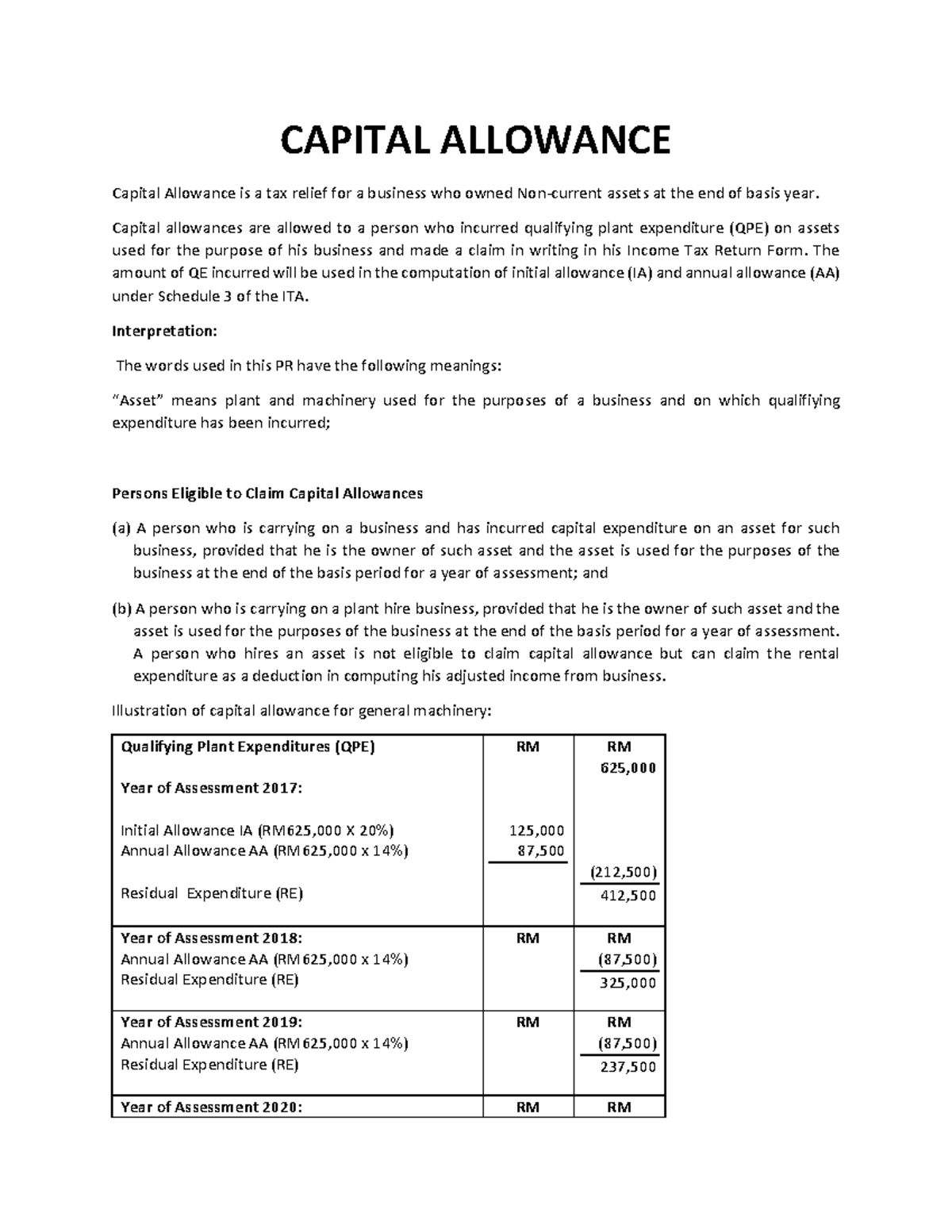

A lease is a contract where a party is the owner lessor of an asset leased the asset to the lessee at a consideration rental either fixed. The initial allowance is established at a rate of 20 percent depending on the assets original cost at the time the capital. Small value assets with values not exceeding RM 2000 are eligible for.

08022022 By Stephanie Jordan Blog The initial allowance is established at a rate of 20 percent depending on the assets. In general capital gains in the country. For Asset Class say Office Equipments Initial.

Many taxpayers are unaware that this form of tax deduction could lead to their companys efficient. - cost of assets used in a business such as plant and machinery office equipment furniture and fittings motor vehicles etc. How To Calculate Capital Allowance Malaysia.

We have a requirement to calculate Tax Depreciation for Malaysia with reference to the Capital AllowanceThe scenario is like this. Capital Allowance Calculator Tax Relief Calculator Catax. QE for capital allowance claim is RM160000.

Capital Allowances study is important to ensure the amount of claims is made correctly. Your capital assets are also not subject to this tax system. Tax tables for the specific tax rates of specific capital allowances are available for ease of computation.

Capital allowance Initial allowance is granted in the year the expenditure is incurred and the asset is in use for the purpose of the business. Scenario 2 Cost of preparing the site amounting to RM20000 exceeds 10 of the aggregate cost. Your company may write off the cost of an asset over 1 year 3 years or the.

There are a few methods for calculating capital allowances. Qualifying expenditure QE QE includes. 72018 Date Of Publication.

Capital Allowance for Leasing Asset. Capital allowance is only given to business activity. The person who has the right to claim capital allowance is the person who has expended on the purchase or acquisition of the said asset.

5 Capital And Industrial Building Allowances Initial Chegg Com

Solved The Following Is The Information Regarding Maya Enterprise Compute The Amount Of Capital Allowance Balancing Allowance Or Balancing Charge Course Hero

Solved Capital Allowances Business Income Course Hero

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

R D Capital Allowances R D Capital Expenditure Explained

Solved The Following Is The Information Regarding Maya Enterprise Compute The Amount Of Capital Allowance Balancing Allowance Or Balancing Charge Course Hero

Capital Allowance Calculation Malaysia With Examples Sql Account

Balancing Adjustments On Pools And Review Of Capital Allowance Computation Acca Taxation Tx Uk Youtube

Download Teacher Salary Slip Excel Format Exceltemple Teacher Salary Teacher Help Free Resume Template Word

Solved Capital Allowances Business Income Course Hero

F6 P6 Capital Allowances Youtube

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

Malaysian Companies Solar Tax Incentives By Helmi Medium

Notes Capital Allowance Capital Allowance Capital Allowance Is A Tax Relief For A Business Who Studocu

Superior Taxcomp Import Capital Allowance From Excel File Youtube

Preparing The Capital Allowance Computation Acca Taxation Tx Uk Youtube

Ias 12 Example Accelerated Capital Allowances Acca Financial Reporting Fr Youtube

- undefined

- how to calculate capital allowance malaysia

- our daily bread malaysia

- syarikat terkenal di malaysia

- kl sentral to bangsar

- amount due to director meaning

- kata kata sedih akhir zaman

- jadwal kereta solo tasikmalaya

- kedai basikal kanak kanak

- biodata ozlyn isteri johan

- warna cat dalam rumah kombinasi

- malay mail on line

- inspirasi dekorasi kamar tidur sempit

- bunga hias di ruang tamu

- hiasan dinding kelas bendera merah putih

- minum minyak zaitun sebelum tidur

- tulang telapak kaki fungsinya

- download video kata kata balikan sama mantan

- teka silang kata online

- dekorasi kamar tidur ibu